Freight Factoring: A Complete Guide for Trucking Companies

Freight factoring is a quick way for trucking companies to get paid faster, avoiding the slow payment process in the industry. Most carriers factor their invoices because having cash in your account when you need to cover fuel and payroll is better than waiting for the full amount from brokers.

This guide breaks down what freight factoring is, how it helps, and why you might want to use it. Keep reading for the details and bookmark the page for future reference.

[PS: Want to talk to someone about freight factoring? Call the Bobtail team at 1 (410) 204-2084.]

Table of Contents:

- What Is Freight Factoring?

- Is Factoring Right For Me?

- How Freight Factoring Works

- How Much Does Factoring Cost?

- How To Choose A Factoring Company

- Signing Up For A Factoring Service

- Other Frequently Asked Questions

What Is Freight Factoring?

| Freight Factoring (noun) ‘frāt ‘fak-tər-ēŋ A financial product that provides quick (usually same-day or next-day) funding for fulfilled trucking invoices, more formally known as accounts receivable financing. |

“Factor” can also be used as a verb: the act of receiving advance for unpaid trucking invoices. (e.g. “I factored the load already.”)

[For more explanations of common factoring terms, see our industry glossary.]

From a distance, factoring may look like a loan: factoring companies pay you funds that they expect to recoup at a profit, sort of like a bank.

But factoring is not a loan. Factoring companies don’t charge interest. Factored funds don’t show up on your credit report or count against credit limits.

What factoring companies do, essentially, is buy your invoices. They pay a bit less than the value of the invoice, but you get paid immediately, without headaches. Later, the factoring company collects the invoice’s full amount from your customer (the shipper or broker).

In the end, you get funds when you need them; the factoring company gets their percentage; and your customer takes their time to pay. Everybody wins.

Why is factoring so common?

Factoring is widespread because the trucking industry typically operates on 30-, 60-, or even 90-day terms. This means brokers can have up to three months to pay invoices after you’ve already completed the work.

Unless you have a huge amount of operating capital—rare for owner-operators and growing fleets—this reality of the industry can lead to cash flow problems.

Factoring arose to solve that problem.

Freight Factoring As An Outsourced Back-Office Solution

The cash advance is just one of the benefits of freight factoring.

Owner-operators usually don’t have a lot of time for accounting, record-keeping, or hounding brokers and shippers for late payments. The same is true for small fleets and new trucking companies operating without a full office staff.

The solution is to outsource some of your vital back-office tasks.

Factoring companies often provide these services, which are part and parcel of the factoring process. Start a factoring relationship to keep cash flowing, certainly, but also to outsource a variety of back-office work like:

Customer credit checks

Should you accept that load from a company you’ve never heard of, or is there a chance they’re a scammer? Factoring companies can help with these decisions; they keep their own credit profiles on shippers, and can even run independent credit checks before accepting a new company’s business.

At Bobtail, we provide these credit checks on brokers to our clients for free on our mobile app, web app, and via SMS.

Outbound invoice processing

Sending and following up on invoices can be hectic. You’ll spend a lot of time on hold to get payment statuses, and the level of administrative work can be overwhelming if a problem arises.

At Bobtail, we’ll handle this part of the business for you, making sure invoices reach the right person and issues are resolved quickly.

Soft collections

It’s a lot of work to chase down a late payment. When you factor an invoice with Bobtail, we’ll work with your customer to make sure all funds get where they need to be—long after you’ve already been paid.

But be careful: not all factoring companies will make the effort to follow up with brokers, so make sure you choose your company wisely!

Financial reporting

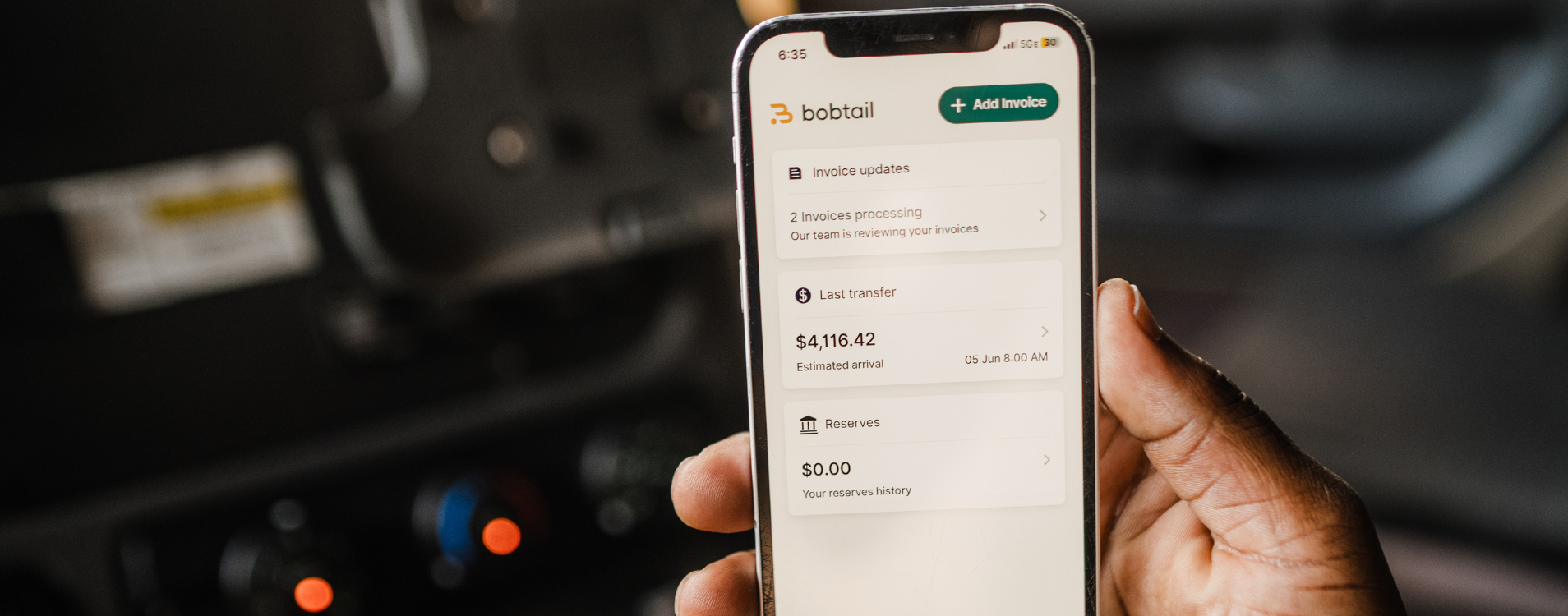

Many factoring companies provide detailed online reporting on all your shared transactions. For example, the Bobtail Dashboard provides simple access to all invoice updates, bank transfers, upcoming chargebacks, and factoring paperwork.

Some trucking companies factor invoices because they need cash quickly. Others partner with factoring services because they don’t have the office staff to handle collections or accounts receivable. Most do it for a combination of these benefits.

Is Factoring Right For Me?

If any of these scenarios apply to your business, freight factoring can help you succeed:

Slow cash flow makes it tough to keep up with expenses.

Fuel, payroll, truck maintenance, insurance: Trucking company owners have a lot of expenses. Without dependable cash flow, you can’t keep trucks on the road.

If you can’t wait 30 or 60 days for money you’ve already earned, consider factoring.

You’d like to invest in your business, but all your credit goes toward day-to-day operation.

Another truck or trailer could greatly increase your company’s profits—but to grow, you need access to capital. Typically, that comes from credit. If you’re consistently hitting your credit limits just to buy fuel, it’s time for a new approach.

Freight factoring keeps your funds flowing without affecting credit limits, so you can devote credit to growth instead of survival.

You spend too much time on billing and collections.

Companies devote entire teams to billing, collections, and related accounts-receivable tasks. If you’re an owner-operator busy delivering loads or a small fleet owner without all the resources in the world, that team is you—unless you find a factoring partner to handle the paperwork for you.

With Bobtail, you just submit documents and get paid. We handle the rest.

You have customers who refuse to pay what they owe.

A lot can go wrong in the trucking industry. Companies may go bankrupt out of the blue. There may even be willful bad actors out there. Factoring companies provide a layer of security that can protect you from a missing payment.

At Bobtail, we provide free credit checks on request, so you can choose customers who are accredited, with a track record of doing the right thing by their carriers. If something does go wrong, our customer service and operations teams will work hard to mediate the situation with brokers and shippers.

You’re stressed about keeping money flowing into your trucking business.

Peace of mind shouldn’t be an afterthought. With a factoring partner like Bobtail on your side, you can rest easy knowing your invoices will get paid quickly—and your dedicated account manager is always ready to provide support, information, and assistance along the way.

How Freight Factoring Works

Now that you know what factoring is, let’s discuss how it works. Here’s a step-by-step walkthrough of a typical factoring process.

- You deliver a load.

Carriers typically bill after the job is complete. That’s no different with a factored invoice. - You submit job documentation to your factoring company.

You’ll need to deliver a few documents to factor an invoice. These include:- Key invoice information (shipper or broker’s name, load number, rate)

- A clear bill of lading (BOL)

- The job’s rate confirmation

Digital documentation submission is simple with Bobtail’s mobile and web apps. Scan or upload documents, enter invoice information, and you’re done.

- We pay you.

Bobtail deposits funds directly into your bank account. We offer same-day payments on all invoices submitted before 11 a.m. Eastern time, and next-day funding for later submissions. - We collect payment from your customer.

When the bill comes due, your customer pays it directly to the factoring company.

How Much Does Factoring Cost?

You’ll hear a lot about factoring rates, but what you really need to focus on is the total cost.

Sure, a low rate looks great, but don’t be fooled.

Most factoring companies sell customers on low rates. However, their agreements include terms, conditions, and extra fees that make factoring with them a lot more expensive than it looks at first glance.

Learn more: Freight Factoring Contracts: What To Watch For

For example, let’s say Factoring Company A offers you a 2.5% rate while Factoring Company B offers you 3.24%. Take a look at the difference:

| Factoring Company A | Factoring Company B |

| Rate: 2.5% | Rate: 3.24% |

| Additional fees: – ACH transfer fee: $15.00 – Invoice fee: $4.00 | No additional fees. |

| Total cost of factoring a $1,200-invoice $49.00 | Total cost of factoring a $1,200-invoice $38.88 |

You can clearly see that factoring with Company A is actually more expensive, even though they advertise a lower rate.

At Bobtail, our factoring rate is the only amount you will have to pay. What you see is what you get. No hidden fees. We hate fine print as much as you do.

And long-term contracts? Forget about it. We believe in flexibility. No long-term commitments. You call the shots. Factoring should work for you, not the other way around.

Choosing a Freight Factoring Company

There are a lot of factoring companies competing for your business. You may have received calls from multiple companies promising the lowest rate and fast payments.

As we mentioned above, not all freight factoring companies are what they seem. It’s important to look into the details and verify all the information any salesperson gives you (that includes Bobtail salespeople!).

Here are some guidelines when shopping for a factoring service:

Read reviews.

You can find good and bad reviews for any factoring company. Focus on the bigger picture and ask yourself these questions:

- Do the reviews appear legitimate?

- Do they reference specific people or situations?

- Have any of the reviews been updated after a negative experience was resolved?

- Does the company respond to the reviewers?

Find reviews for our freight factoring service here on TrustPilot.

Understand what you’re signing.

Before choosing a factoring company, read through the agreement carefully. Ask questions. Be sure you understand all the risks and benefits of signing up with their service.

Specifically, ask these questions:

- Contract term: how long is the contract? Will it automatically renew at the end of the term?

- Volume requirements: do I need to factor over a specific dollar amount to keep my rate or avoid fees?

- Termination: what is the process for ending the contract before the term is up? Is there an additional cost?

- Recourse vs. non-recourse: what happens if the broker doesn’t pay the factoring company? Under what circumstances am I protected from chargebacks?

- Reserve funds: does the factoring company hold an additional percentage of the invoice’s value until my customer pays?

Ask to see the factoring app.

How much you pay for a service is not the only factor to consider. You also want to know what it’s going to be like to use it.

Ask the representative you’re talking to for a demo of the factoring app. You’ll quickly see how user-friendly the technology is. Ask yourself:

- How easy is it to submit an invoice?

- Can I quickly check a broker’s credit rating?

- Does this seem like something I can learn to use in one day?

No small business owner needs yet another application they have to spend a lot of time figuring out.

Signing Up For A Factoring Service

We can’t speak for other companies’ services, but Bobtail makes it easier than most to apply. Simply sign up on our web form or call our sales team at 1 (410) 204-2084, and a Bobtail representative will verify your documents and email you a digital agreement.

Once the agreement is signed, we’ll activate your account within a few business days.

Factoring agreements typically ask for a few pieces of crucial information, including:

- Fleet profile (number of trucks, trailers, drivers, etc.)

- DOT number

- MC number (interstate operating authority)

- Copies of commercial drivers licenses (CDLs) for you and/or company drivers

- Proof of freedom from pre-existing liens

- Other corporate documents (proof of insurance, operating agreements, etc.)

Your factoring partner will perform due diligence, ensuring you don’t have creditors who could be first in line for repayment. But Bobtail doesn’t check a carrier’s credit for factoring, neither personal nor business; we’re only interested in credit ratings for the customers who are responsible for payment.

Once everything goes through, congratulations: You now have a factoring partner!

If you’re factoring with another company and want to switch, we can help you. (Yes, even if you signed a long-term contract, we can help!)

Changing factoring services requires a process called a buyout. Check out our blog, How to Switch Factoring Companies for more detail or contact us!

Frequently Asked Questions About Freight Factoring

1. Do factoring companies make you sign a contract?

That depends on which factoring company you choose. Many traditional providers do lock carriers into contracts, which carry certain risks, such as:

- Long agreement terms, often up to three years at a time.

- Volume requirements, which force carriers to factor most or all of their invoices—even for customer’s they’d rather bill directly.

- Holding reserves, a portion of invoice funds that your factoring company retains until the customer’s payment clears, often in the 10% to 15% range.

- Hidden fees, including charges for bank transfers, credit checks, account set-up, and contract termination.

The good news is that you don’t have to sign a restrictive contract to factor invoices. Bobtail doesn’t make you sign a long-term contract; you choose which invoices you’d like to factor, without volume requirements or limits, and you can come and go as you like with just 30-day notice. That keeps control of your business where it belongs: firmly in your hands.

Learn more: Freight Factoring Contracts: What To Watch Out For

2. What’s the difference between “recourse” and “non-recourse” factoring?

Maybe you’ve wandered into an online debate about recourse vs. non-recourse factoring. Here’s what those terms mean:

Recourse factoring places the responsibility for customer payments in the carrier’s hands. A recourse agreement allows the factoring company to issue carrier chargebacks on funds that customers eventually refuse to pay.

Non-recourse factoring includes some protections for carriers. Usually, it just means that the carrier won’t have to return payments if the broker files for bankruptcy before paying an invoice.

Based on those definitions, non-recourse factoring may look safer. But the conditions that non-recourse agreements cover are fairly rare, and often aren’t worth the higher costs carriers pay for non-recourse factoring.

Non-recourse agreements typically don’t protect carriers from chargebacks associated with late or damaged deliveries, for instance. Non-recourse factoring companies also usually require detailed contracts, sometimes with strict limits on who you can work with. If you want a flexible factoring solution, non-recourse probably isn’t an option.

Bobtail offers recourse factoring agreements—but that doesn’t mean you’ll lose money if a broker or shipper fails to pay. We have several ways to collect on unfilled invoices. If a broker goes bankrupt, for instance, we can draw on the brokerage’s federally mandated bond accounts. They’re required to keep a bankruptcy-protection bond of at least $75,000.

We might also collect from the shipper who hired the broker, which is allowed under U.S. law. Typically, these avenues allow us to collect on problematic invoices without holding the carrier responsible.

Learn more: Recourse Vs. Non-Recourse Factoring: Which Should Trucking Companies Choose?

3. What’s a “notice of assignment,” and what does it have to do with factoring?

When you establish a relationship with a factoring partner, you need to tell customers to pay the factoring company, not your business. That’s accomplished—formally and legally—with a document called a “notice of assignment.”

This document is essentially a contract that clearly lays out the billing relationship between you, your customer, and the factoring company. It ensures you don’t accidentally get paid twice, and keeps all parties fully informed of where funds should flow.

Your factoring provider will issue the notice of assignment; both you and the customer must sign it before you begin factoring. The process is simple with Bobtail, and if you have any questions, your account manager will walk you through the process.

Learn more: What Is A Notice Of Assignment In The Trucking Industry?

4. Do brokers use factoring, too, or is this tool just for carriers?

Brokers do use factoring quite a bit! As market liaisons who frequently work with new shippers, brokers rely on factoring companies to verify that potential customers have good payment histories. Brokers also need access to steady cash flow to pay carriers.

In fact, both brokers and carriers may factor their invoices for the same load. The broker issues an invoice to the shipper who hires them, then the carrier factors the invoice they send the broker.

They’re two different transactions, two different invoices, even though they’re both for the same load—and both parties, brokers and carriers, can factor those invoices.

5. How much should carriers expect to pay for factoring?

Factoring rates vary widely, based on the contract’s terms and conditions, and on the size of the carrier’s business. Regardless of the factoring fee—a percentage of invoice value—watch out for hidden costs, as noted above.

Bobtail doesn’t charge hidden fees of any kind. You just pay one low factoring rate: a maximum of 3.24% for companies with one to three trucks, and less for higher-volume accounts.

We don’t charge fees for set-up, termination, bank transfers, credit checks, or anything else, so you always know exactly what you’re paying. With Bobtail, the factoring rate is the factoring cost—two figures that seem similar, but can lead to big differences.

6. What’s the difference between a factoring rate and a factoring cost?

The factoring rate is the percentage of invoice value that you pay for your factoring service. That’s the 3.24% figure mentioned in the last question, for example—and, as noted, that’s the total cost of factoring with Bobtail.

With factoring companies that charge extra fees, however, you’ll pay more than this rate. The total amount of money you spend on a factoring service is your factoring cost, and it may not end with additional fees. Beyond the factoring rate, you may need to figure the following into your total factoring cost:

- Set-up fees

- ACH fees

- Processing fees

- Monthly fees

- Termination fees

- Labor costs for time spent resolving invoice issues

When considering a partnership with a factoring company, don’t make a decision based on the factoring rate alone. Ask about additional costs, including the average length of a call to their customer service department. Or, for a simpler solution, choose Bobtail.

7. What’s the best way to get started with freight factoring?

The simplest way to start factoring is also the easiest way to continue: Sign up for a free, seven-day trial with Bobtail. As of publication, we’ve funded more than $1 billion worth of invoices, serving thousands of clients.

Our application process is fully digital, and streamlined for quick service. A Bobtail Account Executive will guide you through the agreement process, then an Onboarding Specialist helps you set up your account.

If you have questions later, you can easily contact your dedicated Bobtail support team. They provide quick, friendly help with anything from technical problems to invoice requests.

Our simplified app and client dashboard allow you to factor your chosen accounts, while our flexible month-to-month agreement keeps you free to continue direct billing with whoever you’d like.

This is a factoring tool built by truckers, for truckers, and it’s ideal for the busy owner-operator and the growing fleet alike.