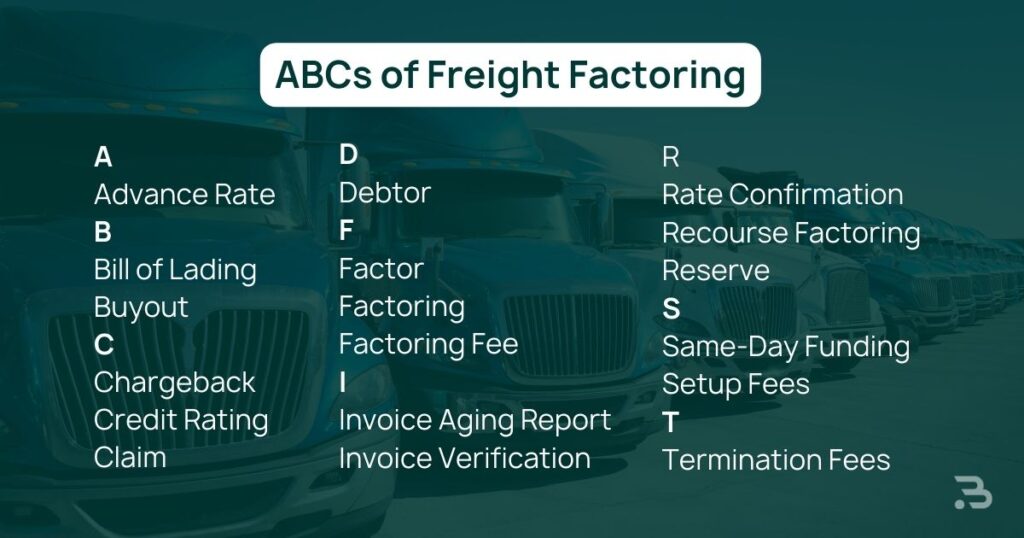

A Simplified Guide To Common Factoring Terms

If you’re new to trucking, the language surrounding this industry can be confusing. Too many carriers get talked into a factoring contract because they don’t understand the terminology factoring companies use to describe their service and fees.

So, we made this glossary of factoring terms so you can start the conversation on an even footing with providers.

Just a quick thing before we get into it, what is factoring again?

Freight factoring is a financial service that pays trucking invoices quickly.

The process is simple: the trucking business gets paid for its open invoices, and then the factoring company collects payment from the shipper or broker who hired the trucking company. The factoring business charges a small fee, while carriers get access to the cash they’ve earned without delay. Win-win.

Factoring Terms Glossary

A

Advance Rate

This is the sum the factoring company pays the carrier for a factored invoice. It’s equal to the total invoice value minus the factoring rate and any reserve funds.

Bobtail does not hold any amount in reserve, so when you factor with us, the advance rate will be the invoice value minus the one simple factoring fee, which ranges between 1.99% and 3.24%.

Example: If you factor with us at 3.24% and factor a $1,000 invoice, you will receive an advance rate of $967.60.

B

Bill of Lading

A bill of lading is a document that lists all the goods shipped on your truck. It’s a legal document that serves as an agreement between the shipper and the carrier.

After delivery, the receiver signs the bill of lading, at which point it serves as proof of delivery.

When you factor with Bobtail, you simply upload your rate confirmation and bill of lading through the app to get funded.

Buyout

If you switch from one factoring company to another, the new one must purchase all the open invoices from the previous factoring company. This is called a buyout.

Typically, the factoring companies negotiate the buyout, so the carrier shouldn’t have to worry too much about it.

Related: How to switch factoring companies

C

Chargeback

A chargeback is when a carrier is required to pay some or all of the advance rate back to the factoring company.

This can happen because the broker refuses payment, goes out of business, or charges unforeseen fees.

At Bobtail, we work with the carrier to avoid chargebacks as much as possible. If a broker refuses to pay or goes out of business, we can collect on the broker’s bond or with the shipper directly.

At a minimum, your factoring company should be able to guide you through these processes before issuing a chargeback. Unfortunately, not all factoring companies do this.

Related: What should I do if a broker doesn’t pay?

Credit Rating

Factoring companies want to reassurance that your customers will pay them when invoices come due. So they create credit ratings to evaluate the creditworthiness of brokers and shippers.

Factoring companies will often make the credit rating system available so the carriers can check a broker’s rating before they book a load. It’s a good idea to complete a credit check for brokers or shippers periodically to make sure you can factor their invoices. Bobtail never charges carriers for credit checks.

Claim

If a carrier is responsible for damages or losses to the products they’re hauling, the shipper or broker may charge them for those items. This charge is called a broker claim, a shipper claim, a freight claim, or just a claim.

D

Debtor

The debtor is the party that pays a trucking invoice. That’s the shipper or broker who hired you for a load.

Declined Invoice

Sometimes a broker or shipper fails their credit check. In that case, the factoring company will decline to factor the invoice. They won’t factor the load. This is called a declined invoice.

F

Factor

The verb “to factor” refers to getting funded for open invoices.

Example: I want to factor the load of electronics I just delivered in San José, California.

As a noun, “factor” means a factoring company.

Example: The factor contacted the broker to confirm the rate on the load of electronics.

Factoring

A financial tool in which a third party purchases invoices from companies, collecting on those invoices from the debtor.

Factoring gives truckers instant funding to maintain a steady cash flow. This is important in the trucking industry because shippers and brokers often operate on net 30 or net 60 terms, meaning they have a month or two to pay their invoices.

Factoring Fee

This is the amount a factoring company charges to advance funds to their clients.

Factoring fees are usually based on factoring rates, a percentage of the total invoice amount.

As we mentioned, Bobtail’s factoring fee ranges between 1.99% and 3.24%, based on the size of your business—and this one simple cost is all we charge. See our entries on Setup Fees, Termination Fees, and Transfer Fees to learn about some of the hidden costs other factoring companies may charge; Bobtail does not.

I

Invoice Aging Report

This document lists all the unpaid invoices a trucking company has factored.

With Bobtail, you can easily see all the invoices you’ve factored on the web or mobile app.

If you’re factoring with another company whose platform is not as intuitive, it’s a good idea to run an invoice aging report monthly, or even weekly, to make sure debtors pay on time. That way, you won’t get hit with surprise chargebacks.

Invoice Verification

Before providing funding for a shipping invoice, factoring companies check with the broker or shipper to confirm the rate and make sure the carrier delivered the associated load successfully. This process is called invoice verification.

N

Non-Recourse Factoring

In a non-recourse factoring agreement, collections insurance limits the scenarios in which the factor can issue a chargeback to the carrier. This insurance is usually limited to occasions when brokers or shippers go out of business and declare bankruptcy.

Related: Recourse Vs. Non-Recourse Factoring: Which Should Trucking Companies Choose?

R

Rate Confirmation

Also known as rate con or load confirmation, this document verifies the agreed-upon pay rate for shipping a single load. It’s an agreement between the shipper or broker and the carrier. Carriers can scan or upload the rate confirmation to the Bobtail app for quick, easy factoring.

Recourse Factoring

This is the opposite of non-recourse factoring. In a recourse factoring agreement, the carrier may be responsible for paying invoices that debtors fail to pay — though factoring companies may have other avenues that protect their clients from chargebacks.

Reserve

Some factoring companies hold a fraction of the invoice value as a sort of security deposit. They keep these funds in a separate escrow account and release them back to trucking companies as invoices are paid.

This leads to some confusing bookkeeping, so Bobtail simplifies the process by never holding reserves. If you see the term “reserve balance” in our app, it refers to the balance on your account.

S

Same-Day Funding

The whole point of factoring is to get funds to truckers fast. With same-day funding, those payments arrive the very day the carrier uploads a rate confirmation and bill of lading.

With Bobtail, invoices submitted before 11 a.m. Eastern Standard Time are eligible for same-day funding. Requests that arrive later in the day are filled the next day. Bobtail does not charge additional fees or higher rates for same-day funding.

Setup Fees

Some factoring companies charge carriers fees to set up their accounts. These may include administrative costs and a charge to file a lien through the Uniform Commercial Code (UCC), a set of U.S. laws that standardize financial transactions; you may see these listed as “UCC fees.”

Bobtail doesn’t charge UCC fees or pass setup costs to our clients; our only charge is the one clear factoring rate.

T

Termination Fees

Many factoring companies lock carriers into restrictive contracts, then charge them a termination fee if they want to take their business elsewhere. This fee can amount to thousands of dollars.

Bobtail offers factoring with no long-term contract, providing you the freedom to leave with a 30-day notice — without termination fees.

Related: Freight Factoring Contracts: What To Watch For

Transfer Fees

Factoring companies send carriers their money with electronic bank-to-bank transactions through the Automated Clearing House (ACH) network. This network charges a fee for these transfers, and many factors pass that cost onto clients. Not Bobtail — we don’t charge ACH fees.

Still have questions about factoring terms or practices? Bobtail is here to help. Call us at 410-204-2084, or start factoring today with a consultation from one of our factoring experts.