How to Avoid Freight Scams and Fraud in Trucking

If you’re running a small trucking company, or thinking about starting one, the most important thing you can do for your business is to learn how to avoid freight scams and fraud.

Double-brokering alone costs the trucking industry $100 million annually. This figure doesn’t even account for the number of losses due to other forms of fraud and theft. In addition to financial losses, freight fraud also damages the reputation and trust among carriers, brokers, and customers.

For small trucking companies, the consequences can be devastating. Smaller companies have fewer resources to recover from significant financial setbacks. So, when smaller trucking operations fall prey to scams, it often leads to bankruptcy.

As a freight factoring company that serves mainly small businesses, we have to deal with these cases on a daily basis. Unfortunately, by the time we’re able to identify a freight scam, oftentimes, the load has already been delivered and the invoice submitted for payment. That means it’s too late for the carrier.

This is why it’s so important for carriers to educate themselves, their drivers, and other support staff on what fraud looks like, how to avoid it, and what to do in the event that you’re caught in the middle of a scam.

Watch our video from the Bobtail YouTube channel and subscribe here.

What Does Fraud in Trucking Look Like?

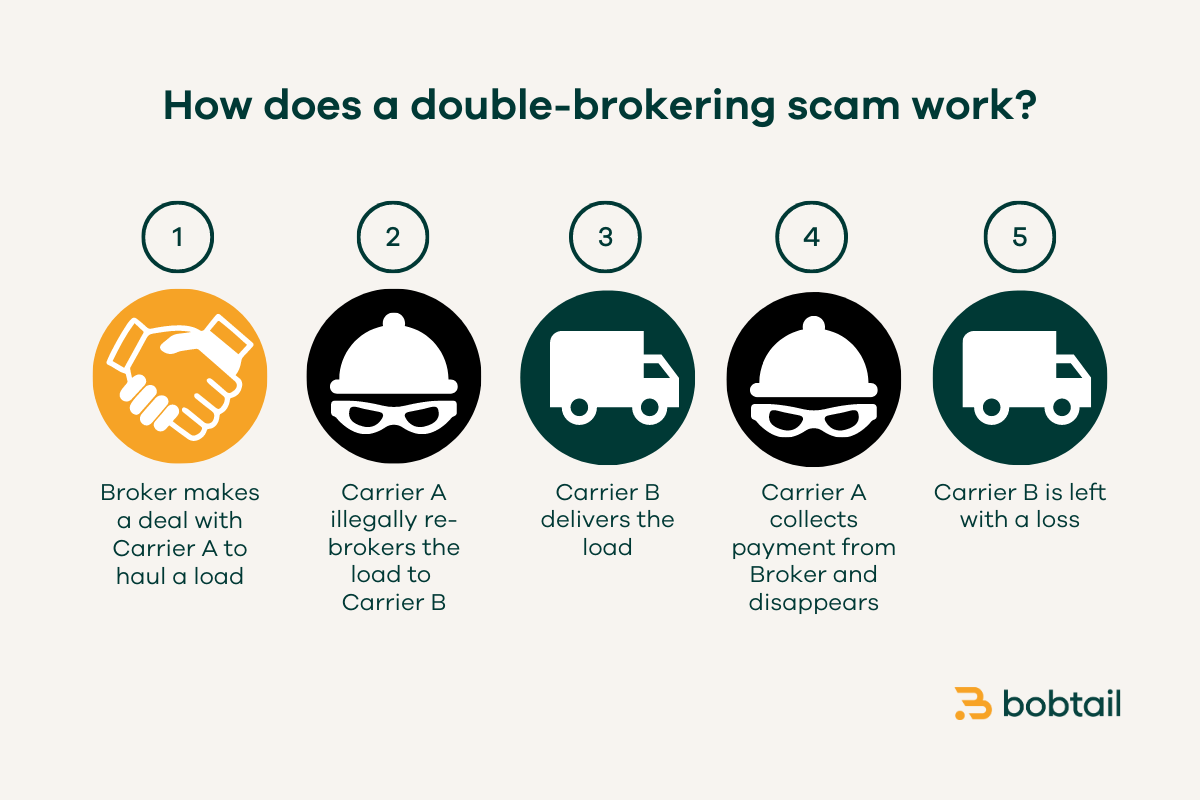

Fraud in the trucking industry can take various forms, but one common scheme is known as double-brokering. This starts, like any load, when a broker finds a carrier to haul the freight. That carrier (let’s call them Carrier A) re-brokers the load, without the original broker’s knowledge or consent, to another carrier (let’s call them Carrier B).

When the load is delivered by Carrier B, Carrier A collects payment from the broker and immediately goes out of business or disappears before paying Carrier B. Carrier B is then left with losses from delivering the load and no payment to make up for it.

Apart from double-brokering, there are several other freight scams that carriers should be cautious about. Some scammers may attempt to broker stolen freight, which could lead to legal complications and damage your reputation.

Additionally, there are cases where fraudulent brokers create temporary entities, offer enticing rates, and then disappear without paying carriers after the job is completed.

A quick note on blind shipments

Let’s take a moment to look at blind shipments. While most blind shipments may be perfectly legitimate, it’s important to understand how to distinguish between a blind shipment and an illegal or fraudulent load.

First, what is a blind shipment? A blind shipment usually refers to a scenario where the receiver is unaware of who the shipper is.

Blind shipments give businesses the ability to conceal information about their importers, manufacturers, or other partners involved in their supply chain. It’s usually done to prevent the parties from skipping over an intermediary to do business directly with each other.

For obvious reasons, blind shipments are more complicated than standard loads. You may be expected to handle multiple BOLs, one for the shipper and another for the receiver, for example.

However, don’t let shady brokers use “blind shipments” as an excuse to conceal your identity as the carrier. Regardless of the information the receiver has on the load, they should still be expecting you (your truck, your driver, etc.) as the carrier.

How to Avoid Being a Victim of Freight Fraud

To protect your trucking business from falling victim to freight scams, here are some things you can do:

Be cautious of rates.

Rates that seem too good to be true probably are. If a broker is offering you 50-100% more than the average rate for a particular route, that should raise a big red flag.

Verify the broker’s legitimacy.

Check brokers’ contact information in multiple places to make sure it matches how you are communicating with them. For example, you’re getting emails about the load from 123freightbroker@gmail.com, but the broker’s website lists shipments@123freightbroker.com.

Use the FMCSA website, the broker’s website, and any other public listings available. If the email or phone number doesn’t match, go to their website and call their main line to check if the load is legitimate.

A Gmail or otherwise generic email address is a red flag and causes to be extra careful. Most professional brokers (and carriers, for that matter) should have a branded domain in their email address. Think hello@bobtail.com as opposed to bobtail@gmail.com.

Pro tip: a classic sign of double-brokering is when you see a TQL, Landstar, or other big brokerage’s freight being listed by smaller brokers. It’s true that those larger brokerages often share freight with each other, but they are extremely unlikely to share freight with a smaller broker.

Lastly, ask if the broker uses a factoring service, as this adds an extra layer of credibility.

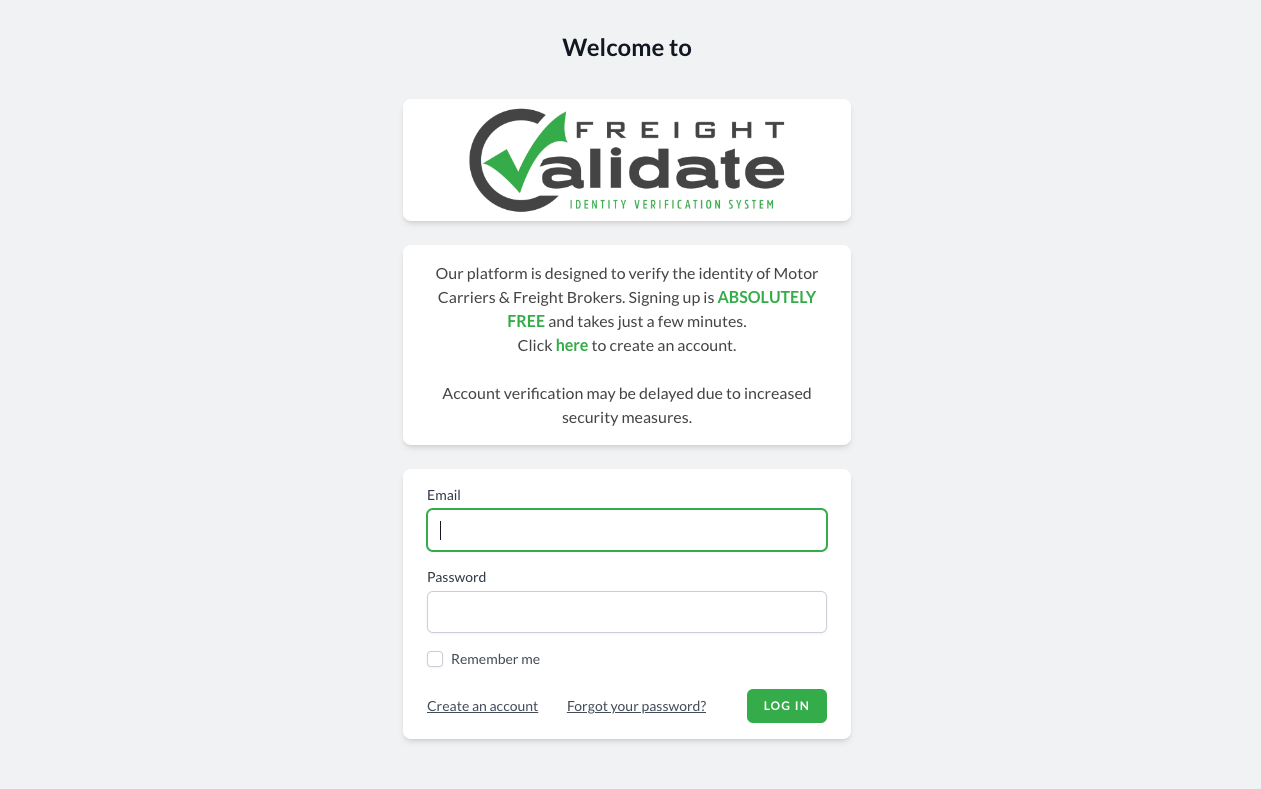

Use vetting websites.

You can use Freightvalidate.com to check a broker’s MC number and avoid suspicious loads. A red X means they have a history of fraud. A yellow warning means they haven’t been caught scamming (yet) but there’s reason to believe they may be a fraudster.

Also, consider joining reputable freight networks like Freightclub.us to connect with vetted customers and legitimate brokers.

Pay attention to communication.

Avoid working with brokers who are unresponsive or unreliable in communication. At the same time, if the broker is too pushy about getting paperwork quickly, this also may be a red flag.

Don’t let your dispatcher or customers intimidate you into sending important documents through unofficial channels like WhatsApp or text messages. Rate cons and BOLs are your money, so handle them with care!

In fact, if you factor with Bobtail, you shouldn’t need to send your paperwork to the broker directly at all. You can send your documents to us using the factoring application and we’ll make sure it gets to the broker for payment. We have our own database of verified broker contact information to ensure that your documents get to the right people.

In addition, keep an eye out for any instructions that seem out of the ordinary, particularly around pickup and delivery. You should never ever have to pretend to belong to a different carrier. Always represent your own company.

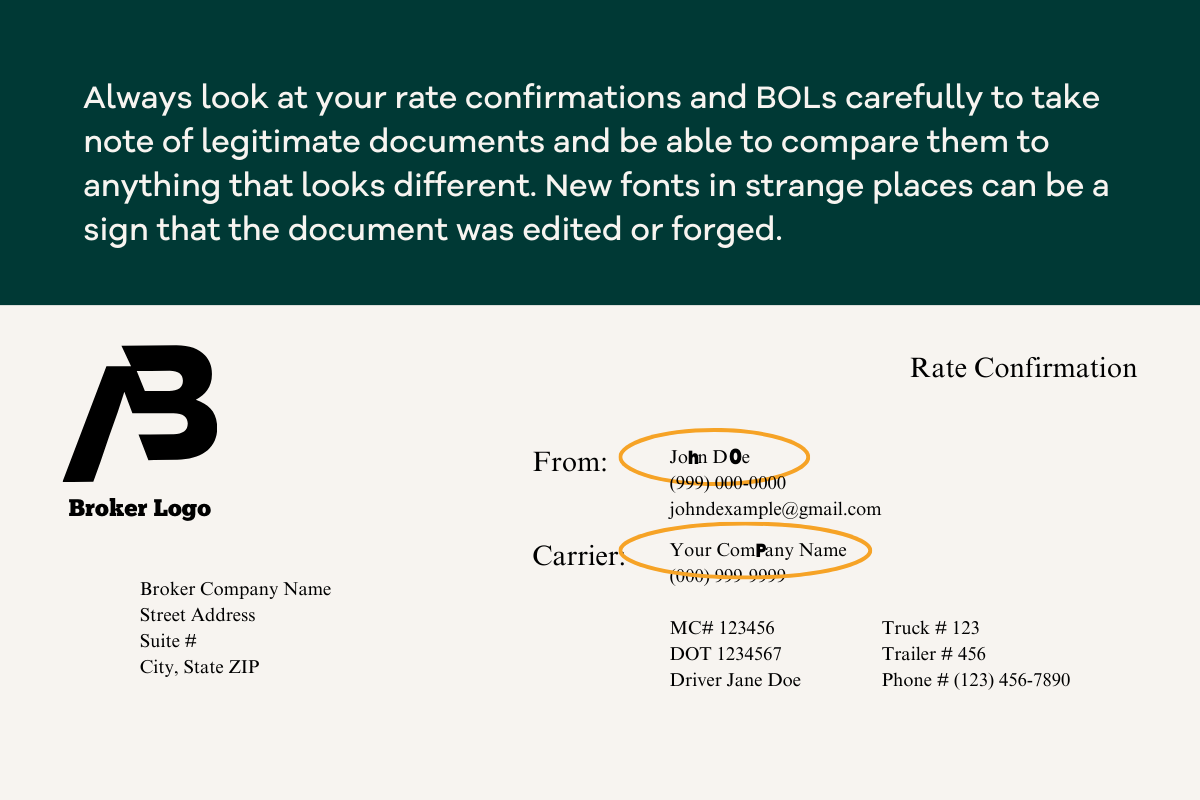

Double-check your documents.

Forgery is a common practice among scammers. The good news is that most of them are not so detail-oriented. Edited or forged BOLs or rate cons often use multiple fonts in odd places, making them easy to identify.

Sign and date your BOLs

Once you get a BOL signed by the receiver, write your carrier name, phone number, MC number, and the date on the BOL before sending it to anyone.

Write this information somewhere where it can’t be edited. Avoid writing it on a completely blank edge that could be easily whited out. Of course, don’t cover up important information on the BOL that could lead to delays in payment.

Train your employees.

When you hire drivers or other support staff, you likely already have set aside a day to train them on your company’s processes and procedures. Fraud prevention is a critical part of that training.

Send them this article to read and then quiz them on it. Create practical exercises for identifying forged documents. Repeat the training every 6-12 months to make sure all your employees are up-to-date on the latest techniques for preventing freight fraud.

At the same time, reward employees who report potential fraudulent activity. Staff members may hesitate to report suspicious activity if they think they can get in trouble for slowing down the team.

Offer special benefits or rewards to team members that help protect the business by identifying fraud. Thank them for it publicly, too, even if the load turns out to be legitimate.

Dispatch your own loads.

Especially when you’re first starting out, you need to build relationships with your customers and understand how the industry works. Too many carriers outsource the task of finding and booking freight too early and end up getting scammed by dispatchers they barely know.

Factor your invoices quickly.

Again, once a load is delivered, your paperwork is how you’re going to get your money. So, turn it into cash as quickly as possible.

Sending your paperwork in on Bobtail’s factoring app takes just minutes and the sooner you do it, the sooner we can identify any issues with the load and invoice the broker.

For example, if the load was double-brokered, we may be able to invoice the real broker faster than the scammer can, especially if you followed our advice above and only sent your rate cons and signed BOLs to us.

Remember, a broker is never going to pay for the same load twice.

Trust your instincts and use common sense.

If a customer is giving you reasons to doubt them, do some extra research before confirming the load or sending them any information. Don’t be afraid to say no. No load is better than a load that doesn’t get paid!

If you’re factoring with Bobtail, call us. We have a lot of experience identifying fraud and can help you avoid losses.

How to check a broker’s credit rating

Another important part of your due diligence checklist on brokers is to check the broker’s credit rating with your factoring company. With Bobtail, it’s easy! You can check broker credit ratings on the mobile app, web app, or by texting us the MC number.

Our broker credit rating system assigns a letter grade (A-D, or F) based on many factors, including credit scores, payment history, time in the industry, and histories of double-brokering and fraud.

While you can technically work with a broker that has a credit rating of “F”, we highly recommend avoiding those brokers. There’s a reason we won’t factor their invoices! Think about it: if we’re unable to collect payment from a broker with all our resources and dedicated collections team, what evidence do you have to suggest that you’ll get paid? Very little.

Remember, checking the credit rating of a broker is only one of many steps you should be taking with every load to ensure it is legitimate.

Again, if you factor with Bobtail, you can always call or email us with questions about the loads you’ve booked. If anything looks or sounds suspicious, call us before you hit the road. We can help you ensure the load is legitimate.

Not factoring with Bobtail? What are you waiting for?? Give us a call at 410-204-2084 any time Monday – Friday, 9 AM – 5 PM EST, or fill out the form on our website to be contacted by a representative.

What to Do If You’re the Victim of a Scam

We hope it never happens, but in the unfortunate event that you fall victim to a freight scam, take the following steps:

- File a police report to help build a case against the perpetrators.

- Report the incident to the US DOT Office of the Inspector General and file a complaint with the FMCSA National Consumer Complaint Database.

- Reach out to the brokerage involved in the scam. They may also be a victim and may be able to get you at least partial payment.

- Notify your insurance company, load boards, and factoring company about the incident. At Bobtail, we work hard to get carriers payments on problematic loads. We can also file reports with the FMCSA and work out a payment plan for possible chargebacks.

- Share your experience with others in the industry to raise awareness and prevent further scams.

How Carriers Can Legitimize Their Business

Yours is not the only business exposed to fraud in the industry. Your customers are vulnerable to freight theft and other scams that can hurt their bottom line or put them out of business altogether.

This is why, especially for new carriers, it’s important to build trust with customers. Here are some ways you can avoid being mistaken for a fraudulent carrier:

- Use a company domain email instead of a generic one. Think, “info@abctrucking.com” as opposed to “abctrucking@gmail.com”.

- Create a simple website with essential company information. This is easy enough to do with tools like Squarespace or Wix.

- Work with a factoring service that verifies your identity during the underwriting process. Bobtail’s Know Your Customer (KYC) process makes sure you are who you say you are, so brokers can be reassured of your identity.

- Provide brokers with necessary documents and vehicle information proactively, including articles of incorporation and photos of your truck(s).

- Request that your insurance policy lists the vehicle identification number(s) (VIN) of your truck(s) so that brokers can cross-reference them with the information you provide.

- Obtain a legitimate business address, not just a PO box or virtual office.

- Avoid sharing a business address with a freight brokerage. This could look suspicious to anyone with experience dealing with double-brokering.

Always stay vigilant

Fraud is an unfortunate reality in the trucking industry, but carriers can protect themselves by staying vigilant and implementing these precautionary measures. By doing so, you not only safeguard your business but also contribute to a more trustworthy and secure trucking market for everyone!

Together, we can combat fraud and ensure the integrity and success of the trucking industry.