How To Understand The Freight Market

Understanding the freight market is an important skill to learn as a trucking business owner for many reasons. Here are just a few:

- Being knowledgeable about the trends of the industry can position you to recognize the signs of changes to come. While predicting rates and volumes outright is impossible, there are some telltale signs that can inform bigger business decisions.

- Understanding your position and your customer’s position in the marketplace leads to a better understanding of your negotiating power. (Negotiating happens to be another critical skill in trucking.)

- Learning about the cycles of the trucking industry can also give you peace of mind. You’ll understand very quickly that neither bad nor good times don’t last forever. Volatile market conditions make planning and saving all the more important.

- Finally, of course, having more knowledge about the industry will help you find better loads and position yourself in areas where you can make the most money.

So let’s try to understand the trucking market from the economic basics to the three cycles of the trucking industry and more.

Leer este artículo en español.

The law of supply and demand

If you’ve ever taken an economics class, this may have been the first thing you learned. If you haven’t, or your economics knowledge is a little rusty, let’s explain:

Supply and demand is a theory that explains the interaction between the people who sell a resource and those who wish to buy it. It’s typically visualized as a graph like the one below.

At a basic level, this economic principle explains that when there are a lot of people that want a good or a service (high demand), but not enough of that good or service to go around (low supply), the price of the item will increase. This is because the supplier can afford to turn away a customer who isn’t willing to pay a premium because there’s someone behind them that will.

On the other hand, when there is more of a good or service than people willing to buy it (high supply, low demand), the price of that item will go down because the supplier needs to give people an extra incentive to buy it.

In the case of the trucking market, the suppliers are the carriers: trucking companies who are selling space for products to be shipped. The demand comes from brokers and shippers who need to get products moved from point A to point B.

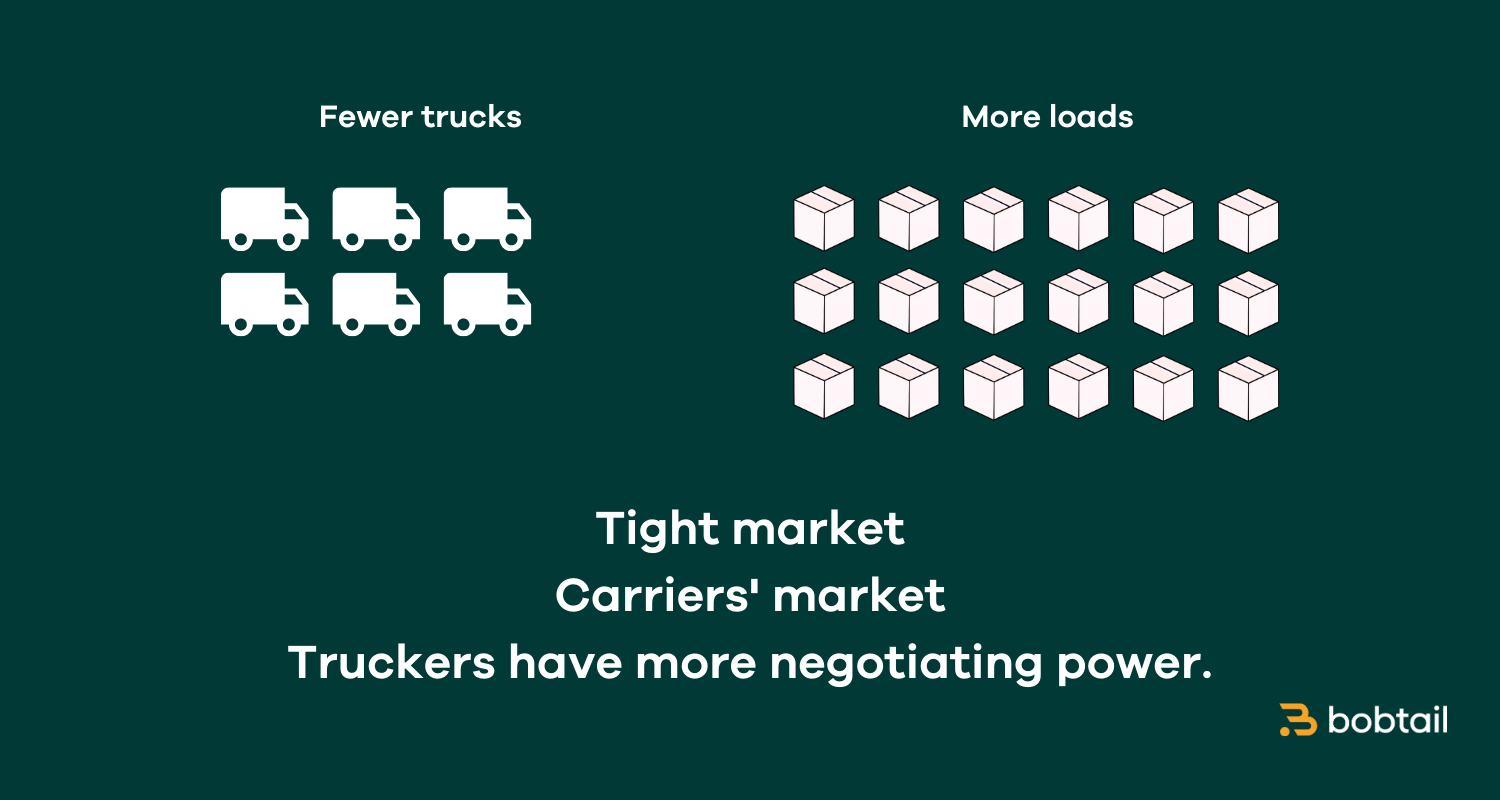

When there are fewer trucks on the road than loads to haul, rates go up because shippers have to compete for trucks. This is referred to as a “tight market” or a “carriers’ market” because carriers have more negotiating power in this environment.

When there are more trucks on the road than loads to haul, rates go down because now carriers are competing for loads. This is called a “loose market” or a “shippers’ market” because brokers and shippers have more negotiating power.

The three cycles of the trucking industry

To truly understand the trucking market, though, you need to go beyond supply and demand. You need to learn what influences changes in supply and demand.

Trucking is generally understood to have three different cycles:

- Seasonality

- Annual procurement

- Market capacity.

Seasonality

This is the most stable of the three cycles because it has to do with deeply ingrained natural and cultural systems: produce and holidays.

- January to March is a low season. The holidays have just ended, the weather is bad, and not much is being harvested in the US.

- April to July is considered the produce season and this increase in shipping volumes means more loads to choose from. US-grown fruits and vegetables start to appear in April and increase in the late spring and summer months.

- August to October is known as “peak season”. There’s still plenty of produce being harvested, students are going back to school, and the holiday season is right around the corner.

- November and December are the holiday shipping season. Shippers need to complete orders and get everything done by the end of the year.’

Annual procurement

In the contract market, shippers work with carriers on an annual basis to agree on dedicated lanes for fixed rates. (We covered the contract vs. spot markets in our article about getting work for new trucking authorities.)

Shippers do this to protect themselves from the fluctuations in the trucking market and streamline operations (i.e. not having to negotiate with carriers on every single load).

Contract rates are influenced by recent market conditions. So, if spot market rates have been high lately, contract rates will follow suit shortly after. Conversely, if spot market rates are down, contract rates will also fall.

The rates agreed on in this process are called “paper rates”, meaning carriers can choose to reject these loads. When a load is rejected by the carrier (aka a “tender rejection”), it ends up in the spot market on a load board.

This is why tender rejections are used as an indicator of the trucking market. Tender rejections are measured as a percentage of the contracted loads that get rejected by carriers.

When tender rejections (also known as the tender rejection rate or index) are high, this means more carriers are choosing to reject their contract rates. They either have no more capacity or there are more attractive rates in the spot market. In contrast, when tender rejections are low, it means fewer carriers are rejecting contract rates and spot rates are likely lower.

Market capacity

This cycle brings it back full circle to the earlier-mentioned law of supply and demand.

An inflationary market in the market capacity cycle happens when there is not enough trucking capacity to move all the shipments everywhere they need to go, i.e. there is not enough supply to meet demand. And because you paid attention so well at the beginning of the article, you know that means that rates will go up.

A deflationary market is when there is more truck capacity than shipments needed, or high supply and low demand. This means rates will go down.

Although we may wish it would, the trucking market rarely reaches or stays at an “equilibrium” where demand and supply are perfectly matched and rates are stable.

This is because, when rates are high, more trucking companies enter the market and put more trucks on the road. This increases supply, driving down rates. When rates decrease, trucking companies leave the market and take trucks off the road.

What influences supply and demand for trucking?

The health of the trucking market can be used to indicate the health of the overall economy. This is because everything we see around us has been in a truck at some point in its journey into the modern world.

Here are some indicators that can help predict what will happen next in the trucking industry:

- Consumer spending: the more people buy, the more loads there are to haul.

- Construction: materials for buildings have to make it to the construction site, right? If new construction is on the rise, there will be more demand for trucks.

- Inventory-to-sales ratio: this is a measure of how many months of merchandise stores have on the shelves. High inventory means they’re having a hard time selling products and thus, lower demand to get more products.

- PMI Index: this is a measurement of manufacturing activity with more than 50% indicating growth and less than 10% indicating a contraction of the industry. When more items are being manufactured, there are more loads to haul.

- Truck orders: keeping an eye on the number of trucks being purchased can give you an idea of how much supply is being added to the market.

Where to get information about the current market trends

Here are the best places to get information about trucking market indicators:

- DAT

- Coyote curve

- FreightWaves SONAR

- National Truckload index

- Earnings reports for large carriers

- News from shippers like Uber Freight and Amazon

There are also some really great content creators on YouTube that do analyses on the freight market regularly. Trucking Made Successful is one of our favorites.

Regardless of whether rates or high or low, you need to get paid quickly for your loads. Most factoring companies will make you sign a year-long contract with an autorenewal and all kinds of hidden fees. But not Bobtail!

When you factor with Bobtail, you’ll sign a simple 30-day agreement and only pay the factoring rate. You’ll also get a dedicated support team and an easy-to-use platform for managing invoices. Click here to sign up and learn just how easy and transparent factoring can be.