How to Calculate Your Cost Per Mile

You’ve probably heard people say that you need to know your numbers to be successful in trucking. There are a lot of different numbers you should know about your trucking business like fuel economy, profit margin, and topline revenue.

However, cost per mile is probably the single most important figure you can track. And with today’s technology, it’s really quite simple to calculate.

Tools to Calculate Cost Per Mile

How much does it cost to run your truck for one mile? Add up all the business expenses over a month, divide the total amount by the number of miles driven, and you have your cost per mile.

You could use a simple spreadsheet to do your math, but there are better ways.

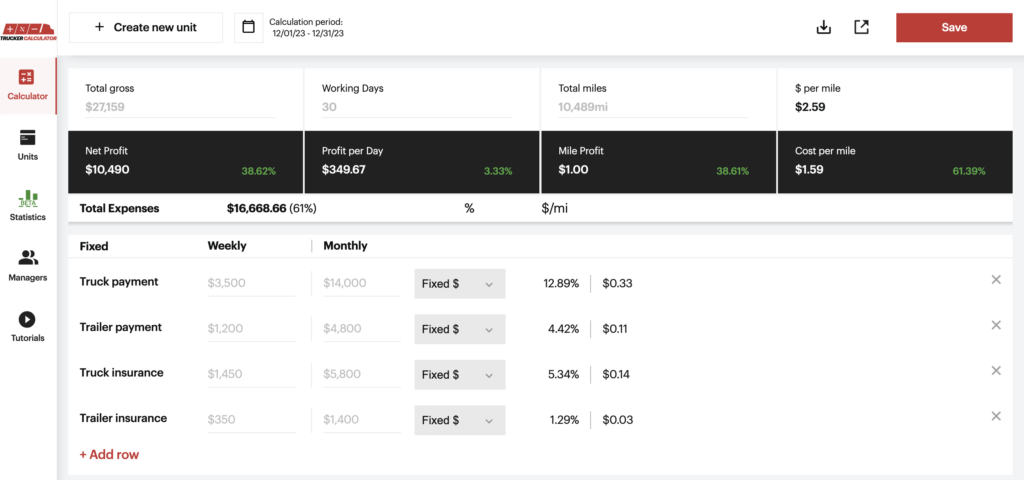

Trucker Calculator is a free tool you can use to calculate cost per mile and other financial metrics for your business. In fact, they recently released a statistics feature that can track financial performance using different variables.

If you use a TMS, you may be able to enter your expenses in the same interface or integrate with a bookkeeping software to find your cost per mile.

But remember: the tool you use is only as helpful as the information you give it.

So let’s take a look at some realistic trucking business expenses for an owner-operator.

Trucking Business Expenses

We’ll start with fixed costs: expenses that don’t change with the number of miles driven. Even if your truck only runs one load, you still have to pay for these things.

Truck Payment

Everything is easier with an example. Say you find a 2021 Freightliner Cascadia for $69,950.

You put 15% down ($10,492.50) and you finance the rest at 11% interest for 36 months.

ET Transport has a great commercial equipment financing calculator on their website. We used it to estimate a $1,946.56 monthly payment.

Then, you find a great deal on a trailer for $22,850. You put 15% down, financing the rest at 11% over the same 36 months – that’s a $695.70 monthly payment.

Insurance

Insurance will be the most expensive in your first year. You can expect to pay about $30,000 per year. That works out to be $2,500 per month.

Your salary

If you’re working for your business, you should be paid just as you would pay any employee. When you’re starting out, you can keep it pretty modest around $50,000 per year. For the month, that’s $4166.67.

Software

This includes things like your ELD, maybe a toll program, your TMS, load boards, Quickbooks, Google for business, your website, and any other software you use to run your business. We budgeted here another $300.

Property

This includes office rent, a space to park your truck, or any other place you are renting or financing to run your business.

A lot of owner-operators live out in the country where they can park their truck for free. For the purposes of this model, let’s assume you can do that.

Total Fixed Costs

Our total fixed costs come to $9,608.93, or $0.96 per mile.

Moving on to variable costs. These are things that change with every mile you run.

Fuel

The cost of fuel will change a lot throughout the year, so you’ll need to update your cost per mile every month or so to keep up with the true cost of doing business.

For a 2021 Freightliner Cascadia, we can estimate that truck gets around 7 miles to the gallon.

With the current national average for diesel at $4.48 (as of October 13, 2023), that’ll be $0.64/mile.

Maintenance

Here’s another expense that varies a lot. Even if you don’t have a big maintenance issue in a given month, we recommend putting away about $1,200 in a rainy day fund for maintenance.

You will be so grateful for that pot of savings when your truck breaks down. Pro tip: the older your truck is, the more money you should save in this maintenance fund.

Taxes

We’re going to leave federal corporate tax and self-employment taxes out of our formula for now since these are paid based on profit.

But there are a few taxes you should keep in mind: Heavy Vehicle Use Tax, IFTA and FICA. We won’t go into detail on these. You can read more about IFTA in this article and learn about FICA on the IRS website.

Let’s be conservative and set aside $5,500 per year for these – that’s $458.33/month.

Factoring

Factoring is a financial service that gets your invoices paid quickly. If you collect directly from the broker, you’ll need to wait usually 30-60 days to get paid. But with all the expenses you have, you’re going to need payments much faster than that.

This is where Bobtail can help: our factoring service can get you paid fast with no long-term contracts and no hidden fees.

Our factoring rate is 3.24% for owner-operators. If you’re running 10,000 miles at the average van rate now of $2.12 per mile, you’ll pay $686.88/month.

Tolls

This expense depends a lot on where you drive. Let’s put aside $500 month.

Miscellaneous

It’s impossible to perfectly estimate every little expense you might have out on the road. But you can plan for incidental expenses. We added an additional $500 for miscellaneous costs.

Total Variable Costs

Our total for variable costs comes to $9,745.21, or $0.97 per mile.

How to Use Your Cost Per Mile

If you’ve been keeping track, this comes to a total of $19,354.14. Divide that by 10,000 miles driven in the month and we get $1.94 per mile.

That might be higher than what you may see in other articles. This is because most models for cost per mile do not take into account the salary of the owner-operator.

Keep in mind that these numbers are meant to show you how to use this model to calculate your cost per mile. You may have a much higher truck payment or a much lower insurance premium. As long as you understand the concept, you can use this model and adjust it based on your situation.

Once you know what your cost per mile is, use it as a baseline for negotiating with brokers. Simply put, you will lose money on loads that pay less than your cost per mile and you will make money on loads that pay more.

Now you know how much it costs to run your business. But how can you make your business more profitable? Read our blog on profitability next to take your business to the next level.