Bobtail Mastercard® FAQs

About the Bobtail Mastercard

What discounts are available with the Bobtail Mastercard?

Our fuel savings partners offer discounts up to ${2.50}/gallon* on diesel at {1,300}+ locations nationwide, including TA, Petro, TA Express, Racetrac, Raceway, Casey’s, Global, Maverik, Speedway, 7-Eleven, Roady’s, Sheetz, and DFS.

Where can I use the Bobtail card?

The Bobtail Mastercard can be used anywhere Mastercard is accepted.

What can I buy with the Bobtail fleet card?

You can use the Bobtail Mastercard to buy fuel, DEF, maintenance, repairs, parts, truck washes, tows, lumpers, equipment rentals, tolls, parking, insurance, and other expenses for your trucking fleet.

What fees does the Bobtail card charge?

There are no monthly, annual, membership, setup, application, or transaction fees.

How can I apply for the Bobtail Mastercard?

Go to card.bobtail.com to start the application. If you have questions about the process, call us at 410-204-2084 or contact us here.

Who can sign up for the Bobtail Mastercard?

Any trucking business owner 18 or older with a registered company and an active operating authority can apply for the card. You must create a Bobtail account or log into your existing account to apply.

How much is the line of credit?

The credit line is dependent on the number of trucks you have and your business’ income. The maximum weekly line is $30,000. This line of credit is subject to change at Bobtail’s discretion. Remember, this is not a credit card.

Is the Bobtail Mastercard a credit card?

No, the Bobtail Mastercard is a type of fleet card. It is a line of credit and you must pay the amount in full each billing cycle to avoid account disruptions. This is not a credit card.

Application Process

How does Bobtail qualify a fleet card applicant?

We use various factors to qualify Bobtail fleet card applicants, including a soft credit inquiry:

- Personal Credit Score – the first beneficial owner listed on the application must have a personal credit score above the minimum requirement (640) to qualify. (If you don’t meet this requirement, you may opt for a secured line of credit, which does not require a minimum credit score. The Bobtail Mastercard is not a credit card.)

- Operating Authority status – your authority must be active with the FMCSA.

- Underwriting – we will verify customers’ identities and business information.

Who cannot access the Bobtail fleet card?

- Sole Proprietors will not be accepted, you must be registered as a business.

- Carriers with inactive operating authorities

- Owner-operators who are operating under another carrier’s authority (leased on)

- Carriers denied by the Bobtail underwriting department

Why was my application denied?

Your application can be denied for any of the following reasons:

- Your operating authority is inactive.

- You or your business information did not pass Bobtail’s underwriting process.

- Your personal credit score is below the minimum requirement.

- If you are denied for the program, you can reapply after 6 months to be considered again.

Using the Bobtail Mastercard

How do I activate my card?

Log in to your account at card.bobtail.com and navigate to the Cards section. Click “Activate” on the card you want to enable, and fill out the information for the card.

How much can I spend in one day with my Bobtail card?

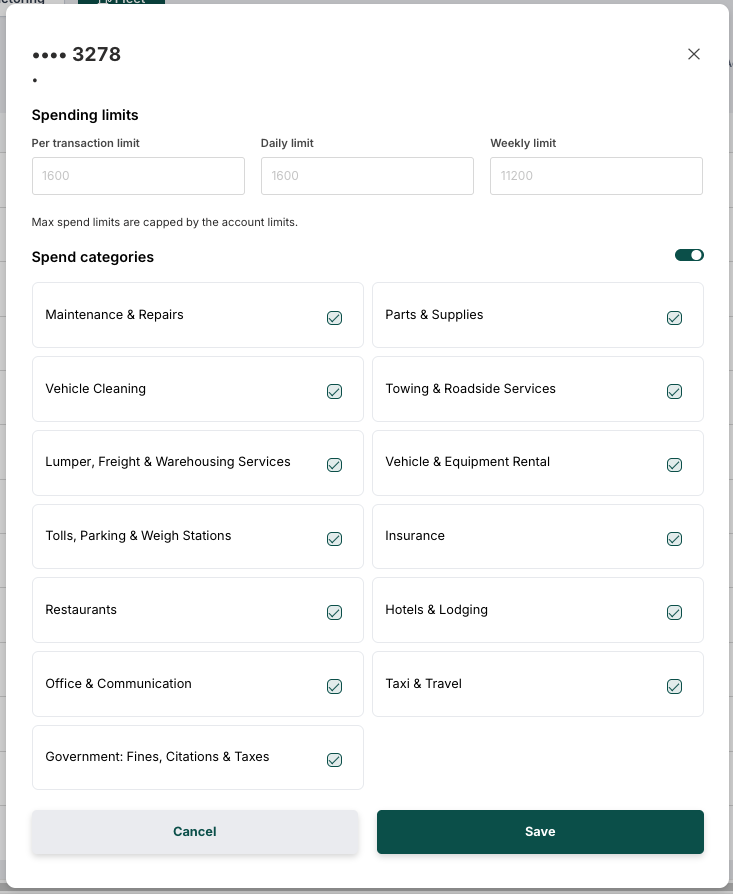

The default daily spending limit is $1,600. To adjust spending limits, go to the “Cards” section in the fleet card app and toggle “Non-Fuel” on the card you want to change. There, you can set per-transaction, daily, and weekly limits.

Here, you can also select and deselect spend categories.

In what circumstances would my account be closed?

Here are the situations where we may close an account:

- The carrier’s USDOT status becomes inactive.

- The business’s credit score, bankruptcy status, liens, or judgment reports place the account in the “high risk” category.

- If we suspect identity theft or fraud, we will freeze the Customer’s card and account to prevent further fraud.

- Non-payment of account after 30 days;

- At the customer’s request

- If one late payment is received within the first 6 months and if two late payments are received within one year, we may close the account.

We will always give proper notice before closing your account.

How can I cancel my card?

You can request cancellation of your cards at any time without penalty. Your account can be closed when your balance is paid in full, and we will set the credit line to $0.